In the fast-paced world we live in today, achieving financial wellness is more important than ever. It’s not just about making ends meet; it’s about Budgeting, Saving, and Investing planning for a secure future and enjoying peace of mind along the way. Whether you’re just starting out on your financial journey or looking to improve your current situation, this guide will offer valuable insights, practical tips, and investment strategies to help you navigate the path to financial wellness.

Understanding Financial Wellness

Financial wellness goes beyond simply having enough money to cover your expenses. It encompasses a holistic approach to managing your finances, including budgeting effectively, saving for short-term and long-term goals, and investing wisely to build wealth over time. By focusing on these key areas, you can take control of your financial future and work towards achieving your financial goals.

Budgeting Basics

Effective budgeting is the cornerstone of financial wellbeing. A budget is a road plan that assists you in monitoring your earnings and outgoings, pinpointing areas for reduction, and allocating your expenditures based on your objectives. To make a budget that suits your needs, do the following:

- Assess Your Financial Situation: Start by calculating your monthly income and listing all your expenses, including fixed costs like rent or mortgage payments, utilities, and insurance, as well as variable expenses like groceries, transportation, and entertainment.

- Set Realistic Goals: Determine your short-term and long-term financial goals, such as paying off debt, building an emergency fund, or saving for a major purchase like a home or retirement.

- Track Your Spending: Keep track of your daily expenses using a budgeting app or spreadsheet. Review your spending regularly to identify areas where you can cut back or reallocate funds towards your goals.

- Prioritize Your Expenses: Prioritize paying for necessities like housing, food, and utilities with your money. Next, set aside money for your goals of saving and indulgence.

- Adjust as Needed: Be flexible with your budget and make adjustments as needed. Life circumstances may change, so it’s important to review and update your budget regularly to stay on track towards your goals.

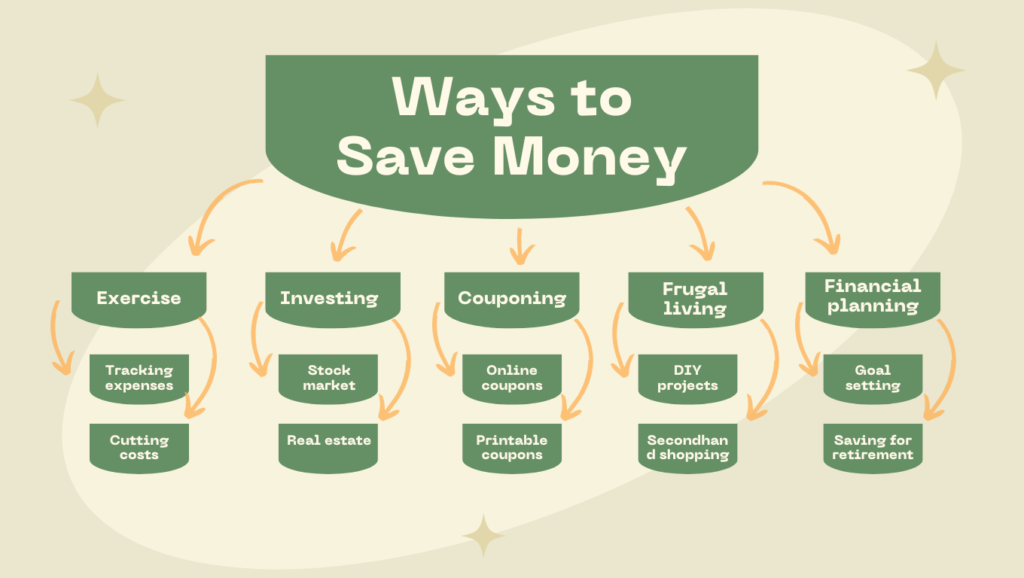

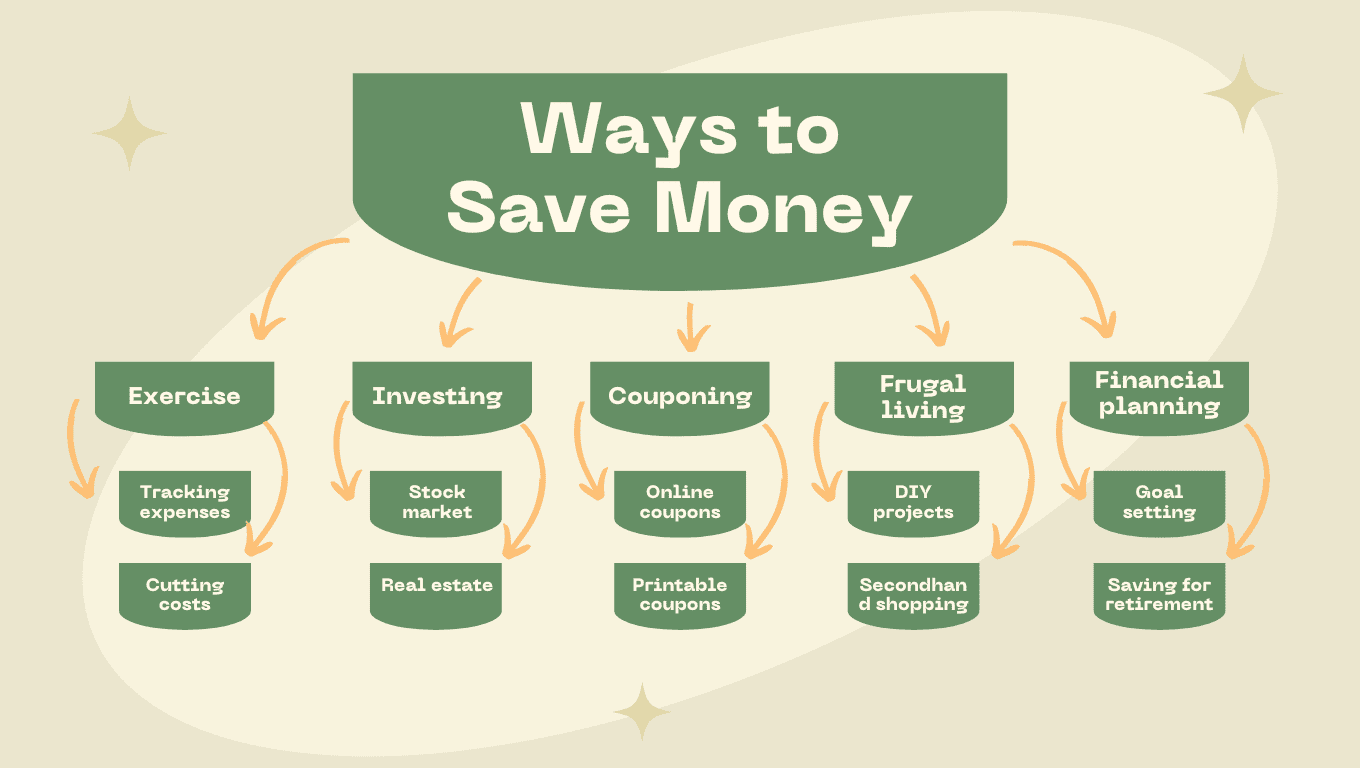

Saving Strategies

Once you have a budget in place, the next step is to prioritize saving for both short-term and long-term goals. Here are some saving strategies to consider:

- Emergency Fund: Start by building an emergency fund to cover unexpected expenses, such as medical bills or car repairs. Make an effort to accumulate enough savings for three to six months’ worth of living costs.

- Automate Your Savings: Set up recurring monthly transfers from your checking to savings accounts. This makes it easier to save consistently and prevents you from spending money impulsively.

- Save for Specific Goals: Whether it’s a vacation, a new car, or a down payment on a house, set aside funds specifically for your short-term goals. Divide your savings into separate accounts for each goal to track your progress.

- Take Advantage of Employer Benefits: If your employer offers a retirement savings plan, such as a 401(k) or a Roth IRA, contribute enough to get the maximum employer match. This is essentially free money that can help you grow your retirement savings faster.

- Reduce Expenses: Look for ways to cut back on non-essential expenses, such as dining out less frequently, canceling unused subscriptions, or negotiating lower rates on bills like cable or internet.

Investment Strategies for Long-Term Growth

In addition to saving, investing is a crucial component of building wealth and achieving long-term financial wellness. Here are some investment strategies to consider:

- Diversify Your Portfolio: To minimize risk and optimize returns, distribute your investments among various asset types, including stocks, bonds, and real estate. Consider investing in low-cost index funds or exchange-traded funds (ETFs) to achieve broad diversification.

- Start Early and Stay Consistent: The power of compounding interest means that the earlier you start investing, the more time your money has to grow. Make investing a habit by contributing regularly to your investment accounts, even if it’s just a small amount each month.

- Invest for the Long Term: Resist the urge to try to time the market or chase after hot stocks. Instead, focus on a long-term investment strategy based on your financial goals, risk tolerance, and time horizon.

- Rebalance Your Portfolio: Regularly review and rebalance your investment portfolio to ensure that it remains aligned with your goals and risk tolerance. Selling investments that have performed well and reinvesting the proceeds in underperforming assets can help maintain your desired asset allocation.

- Seek Professional Advice: Consider consulting with a financial advisor or investment professional to help you develop a personalized investment plan tailored to your individual needs and goals.

Conclusion

Achieving financial wellness requires discipline, patience, and a willingness to make smart financial decisions. By following the principles of budgeting effectively, saving consistently, and investing wisely, you can take control of your financial future and work towards building a secure and prosperous life for yourself and your loved ones. Remember, it’s never too late to start, so take the first step today towards achieving your financial goals.

More Blogs: https://explorewithk.com/top-10-outdoor-activities-in-india/ Explore with Kartik Yadav

+ There are no comments

Add yours